BUSINESS OWNERS & ENTREPRENEURS

$50K+ TO $250K AT 0% APR

FUNDING FOR YOUR BUSINESS

With a Guaranteed Funding Strategy, running your business becomes effortless, because you have a cash flow that works FOR you and not against you.

WATCH THIS VIDEO

THE #1 RESOURCE FOR INDIVIDUALS, ASPIRING ENTREPRENEURS AND ESTABLISHED BUSINESSES

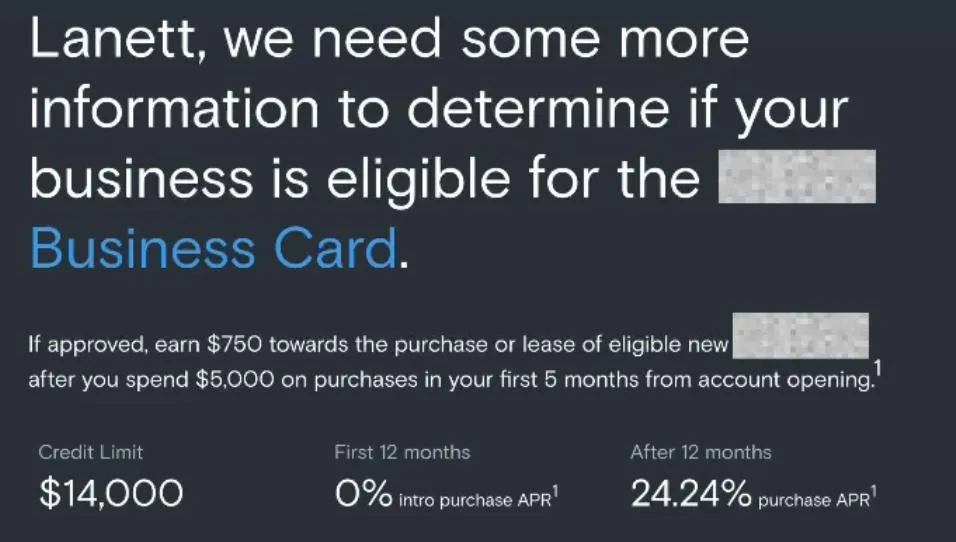

GET PRE-QUALIFIED FOR UP TO $250,000 IN 0% CREDIT LINES

AND UP TO $1,000,000 FOR REAL ESTATE PROJECTS

GET PRE-QUALIFIED FOR UP TO $250,000 IN 0% CREDIT LINES AND UP TO $1,000,000 FOR REAL ESTATE PROJECTS

WE PROVIDE FUNDING FOR ANY PURPOSE:

Individuals

Start-Up Funding

Working Capital

Real Estate Investing

Payroll/Inventory

Expansion/Growth

Individuals

Start-Up Funding

Working Capital

Real Estate Investing

Payroll/Inventory

Expansion/Growth

HOW IT WORKS:

Step - 1

Apply For Funding

Within minutes access the best funding options available with no impact to credit

Step - 2

Book Consultation

Receive your free pre-approval based on a soft credit pull. Schedule a call with a funding advisor.

Step - 3

Receive Funding

Receive your funding in as little as 24-72 hours depending on the products you qualify for.

HOW IT WORKS:

Step - 1

Apply For Funding

Within minutes access the best funding options available with no impact to credit

Step - 2

Book Consultation

Receive your free pre-approval based on a soft credit pull. Schedule a call with a funding advisor.

Step - 3

Receive Funding

Receive your funding in as little as 24-72 hours depending on the products you qualify for.

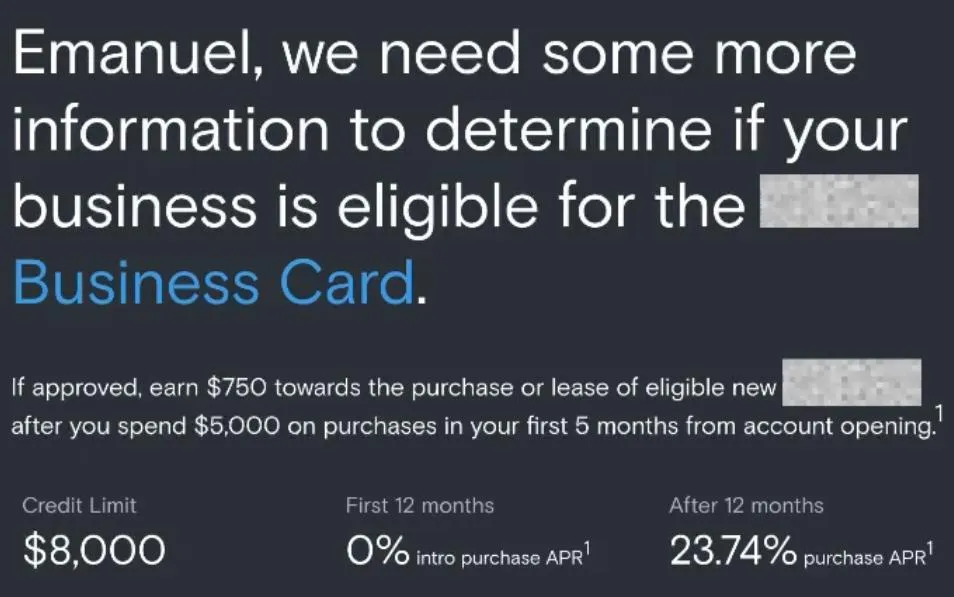

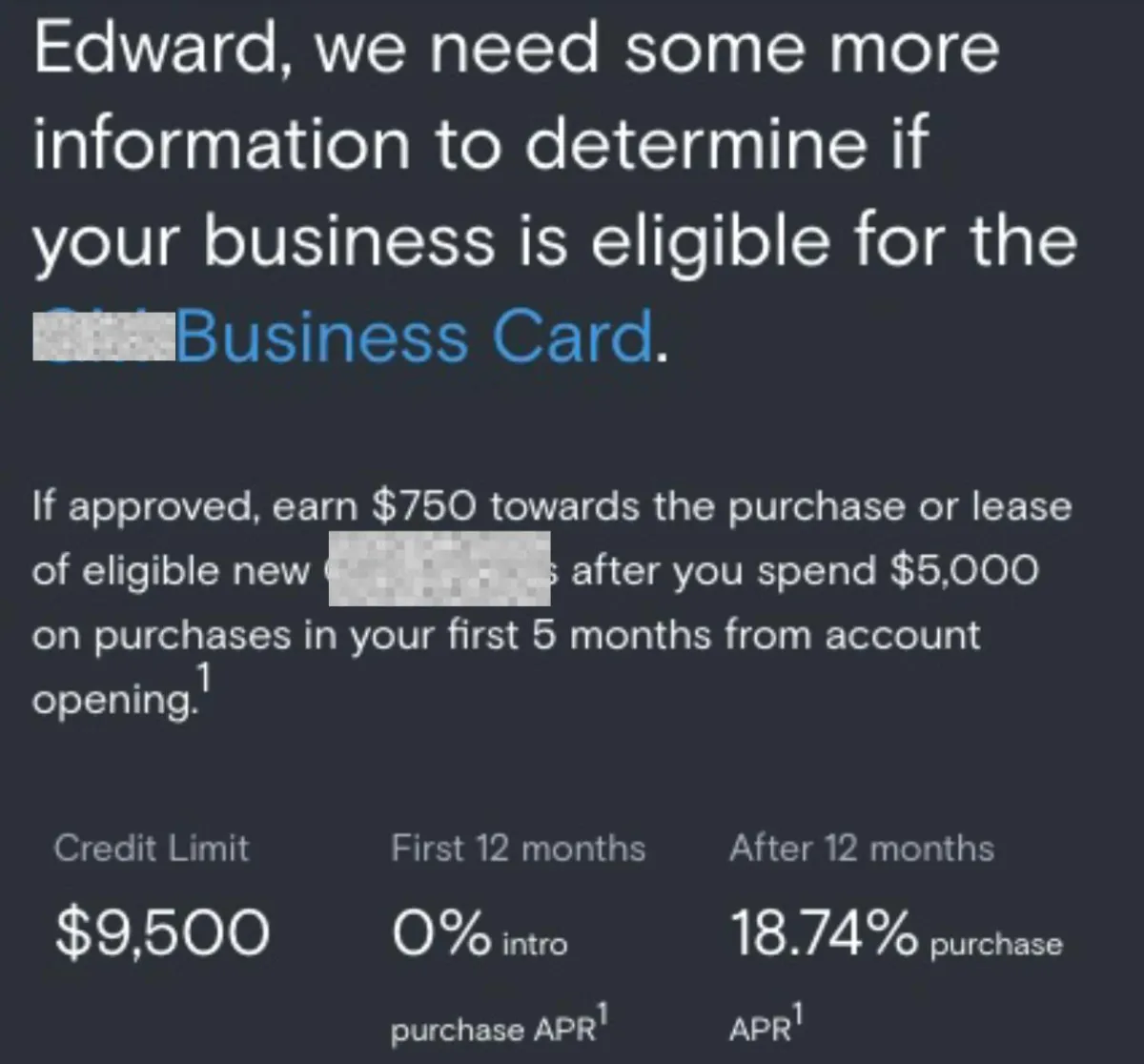

3 WAYS TO QUALIFY:

700+ Fico Credit Score

2+ Credit Cards ($5,000+ Helps)

8+ Open Accounts

No Derogatory Items

Credit Utilization Under 30%

No Late Payments In 24 Months

Personal credit

If met, You can qualify for $50,000 to $250,000 in Personal & Business credit lines at 0% interests for up to 20 months.

Income

With verifiable personal income (W-2/1099 if employed, last 2 years of taxes if self employed) you can qualify for up to $250,000.

Business Financials

If personal credit can not be leveraged due to low scores or lack of credit, business financials can be leveraged. With business bank statement deposits of $17,000 (revenue not profit) per month over the last 90 days there are funding options available up to $250,000.

Personal credit

700+ Fico Credit Score

2+ Credit Cards ($5,000+ Helps)

Minimal Derogatory Items

8+ Open Accounts

No Late Payments In 24 Months

If met, you can qualify for $50,000 to $250,000 in Personal & Business credit lines at 0% interests for up to 20 months.

Income

With verifiable personal income (W2 if employed, last 2 years of taxes if self employed) you can qualify for up to $250,000.

Business Financials

If personal credit can not be leveraged due to low scores or lack of credit, business financials can be leveraged. With business bank statement deposits of $17,000 (revenue not profit) per month over the last 90 days there are funding options available up to $250,000.

DOES THIS RISE FINANCIAL GROUP

ACTUALLY WORK?

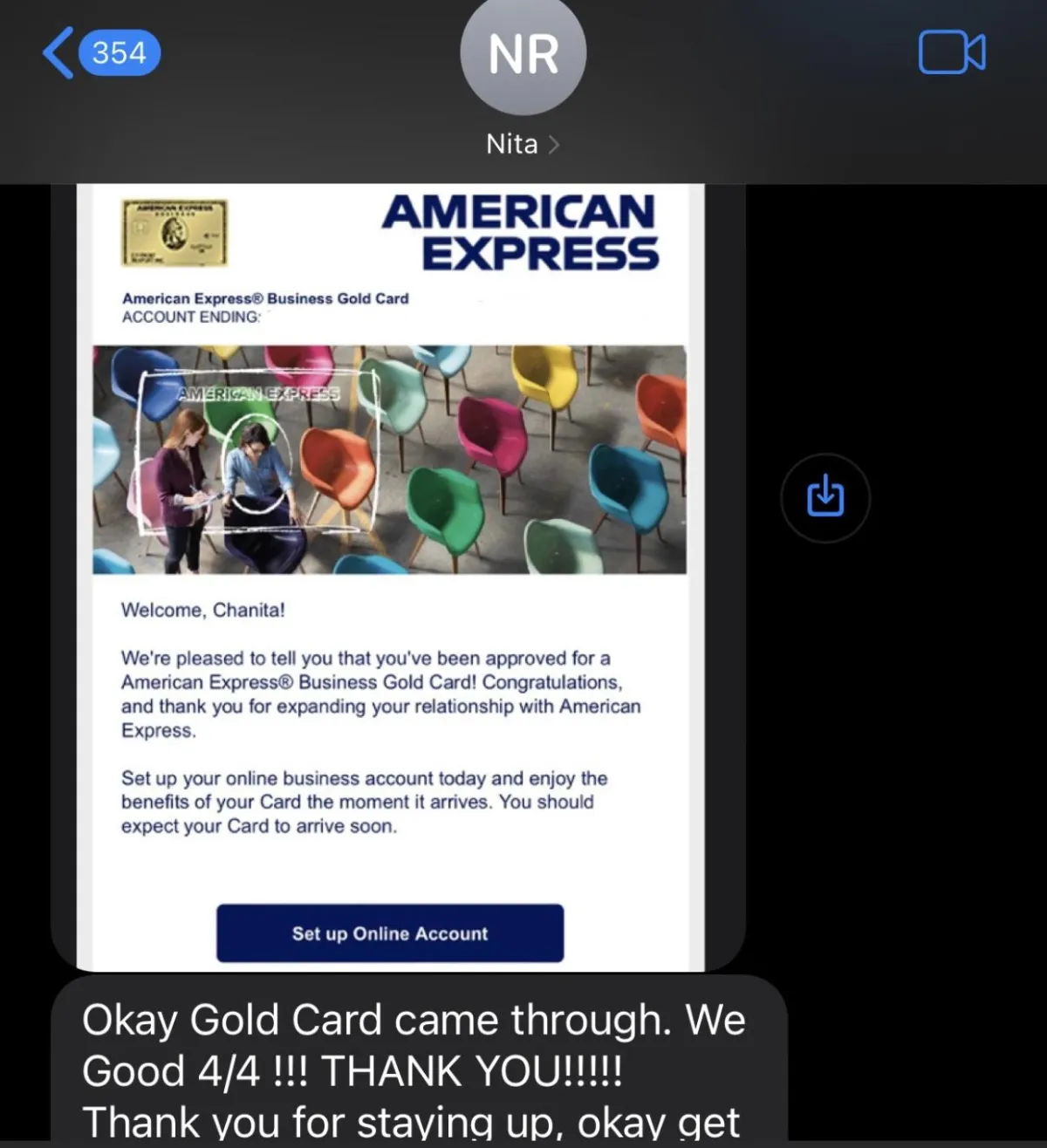

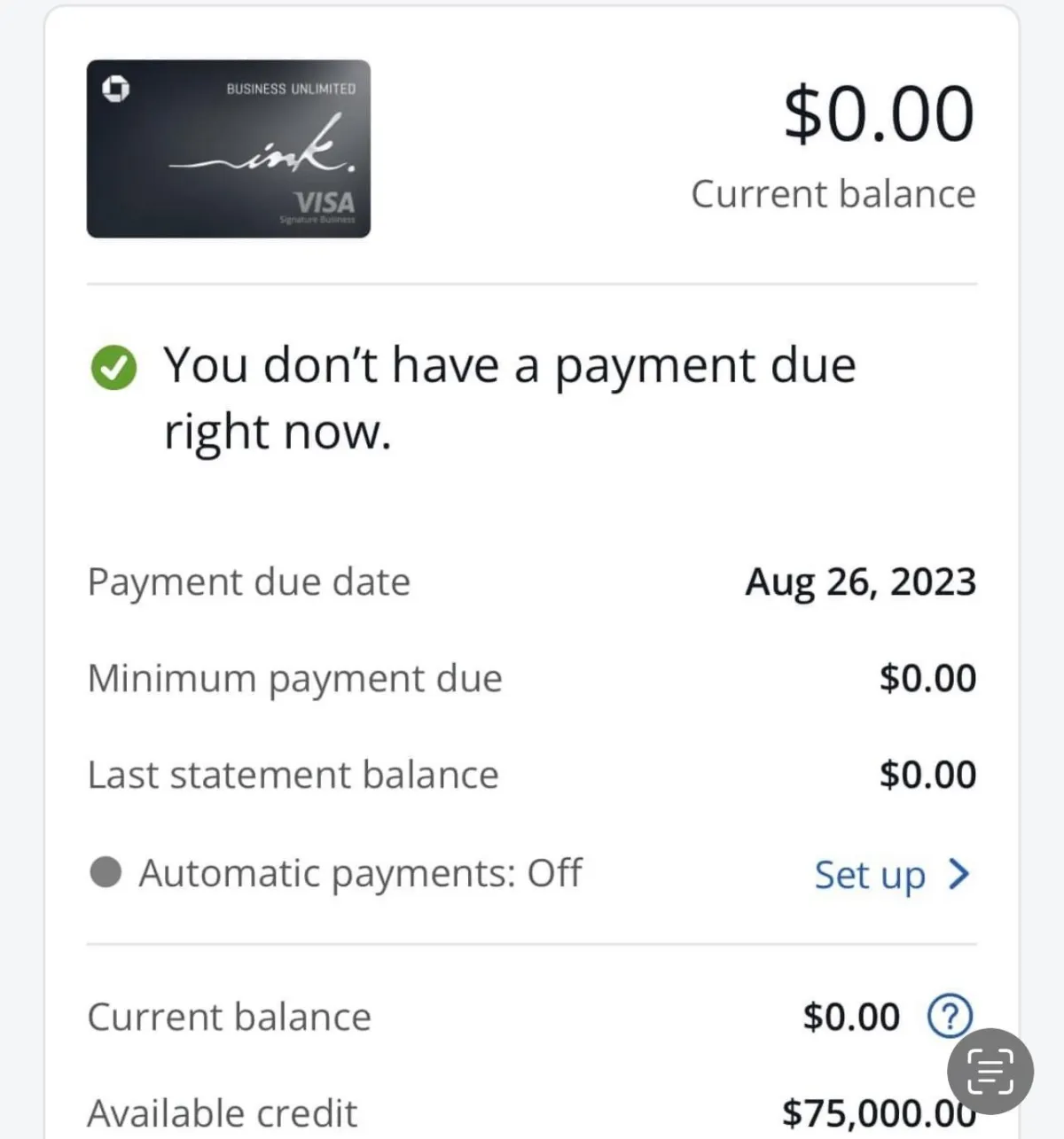

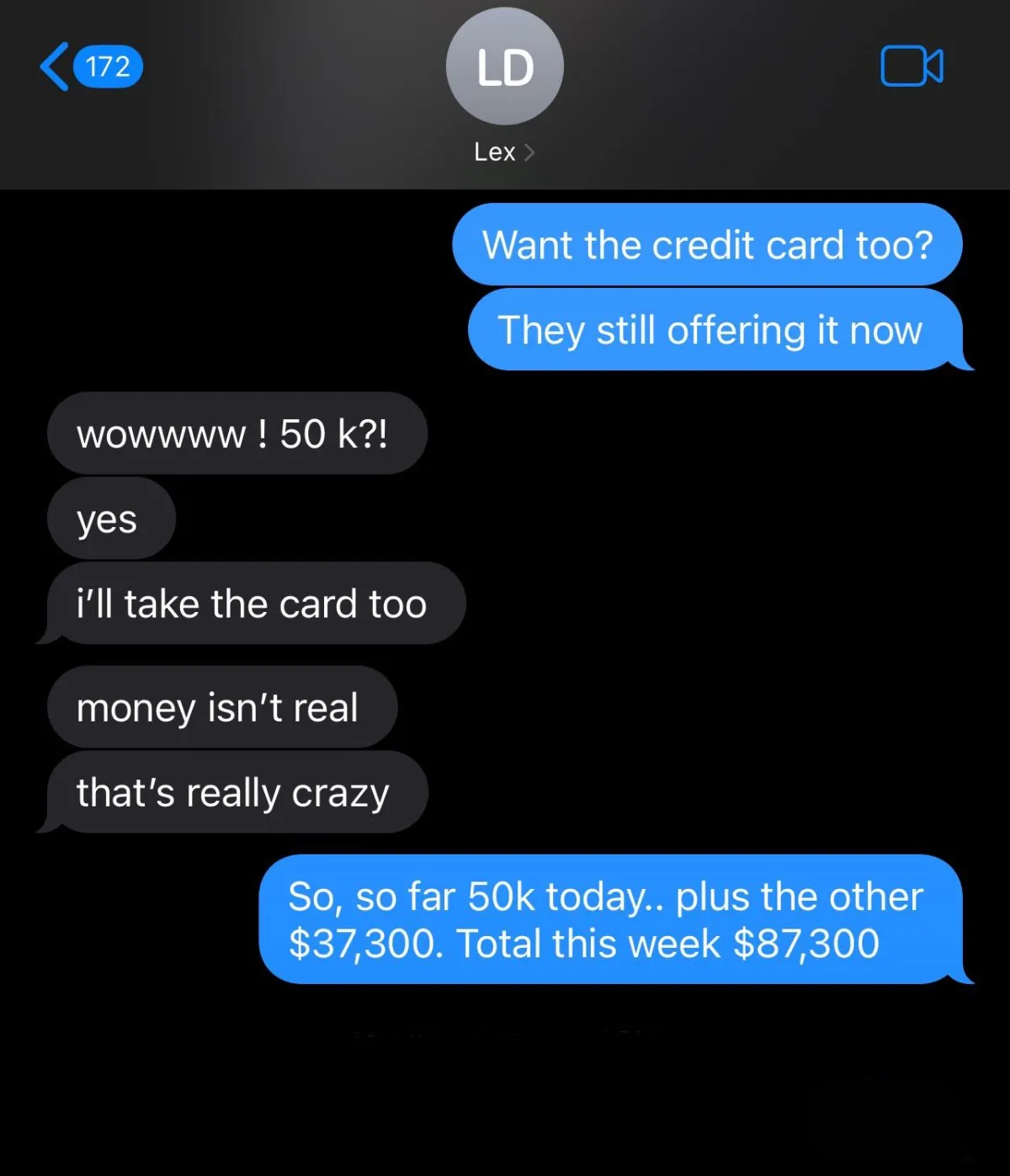

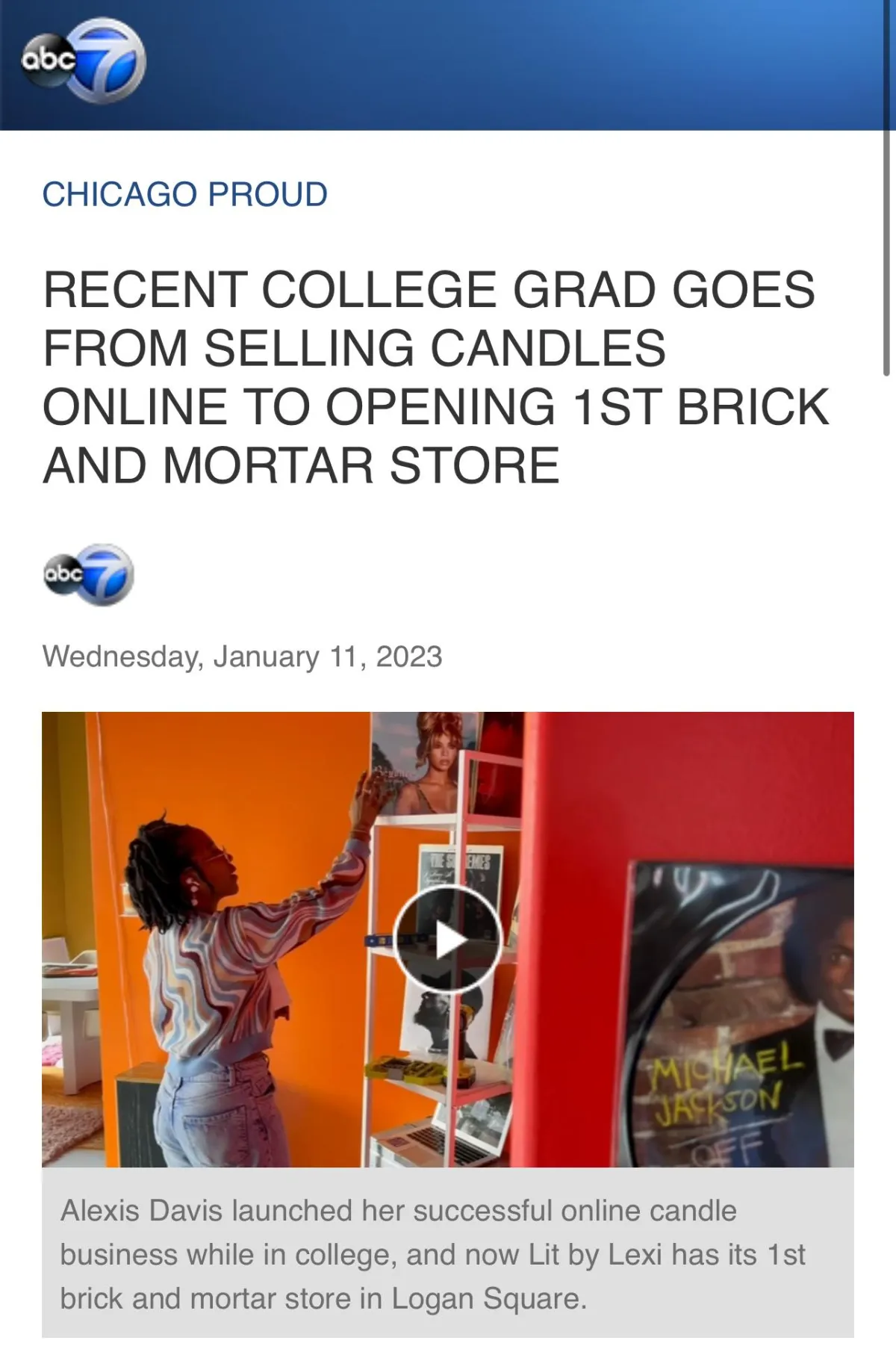

Alexis Davis

Lit By Lex Candle Co.

Niche: Cable, Merch

Result: $89,700 in 28 days

Lit By Lex Candle Co: Alexis secured $89,700 in just 4 weeks working with us.

Alexis approached us with Lit By Lex which was already successful, but said she had been delving into her personal reserves, occasionally tapping into her savings to restock inventory for her candle company. Realizing that continuing on this path would keep her dreams of business expansion on hold, she sought a better solution.

The Process

At the outset, Alexis expressed, 'I just need funding to focus on my expansion.' She was confident in generating revenue through online sales and local market pop-ups but wanted to break free from the cycle of risking personal savings.

We conducted a thorough assessment of her financial situation and crafted a tailored strategy. We assisted with building Alexis's personal credit profile properly to ensure she would become more lendable. She followed each step.

The Result

Alexis secured approvals for a combined sum of $89,700 spread across five credit cards and one business line of credit. With this financial boost, Alexis was able to expand her inventory and purchased her very first brick and mortar located in Chicago, Illinois. Moreover, leveraging business credit, Alexis managed to finance the transportation of a 1,000-pallet load of candles to California for one of the nation's biggest market fairs, a move that significantly amplified her brand's reach.

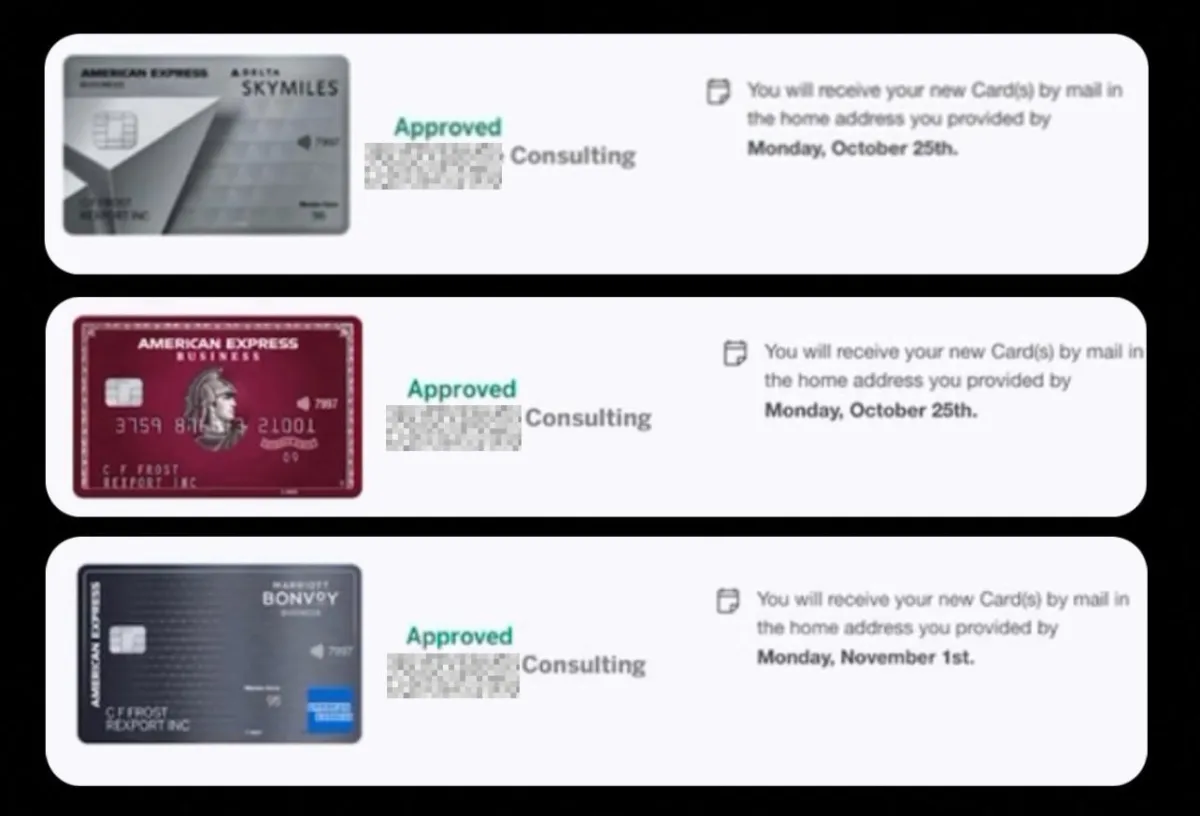

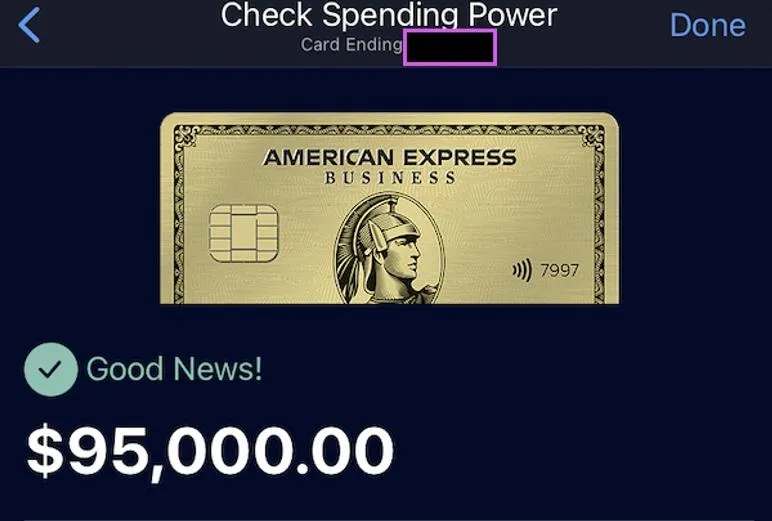

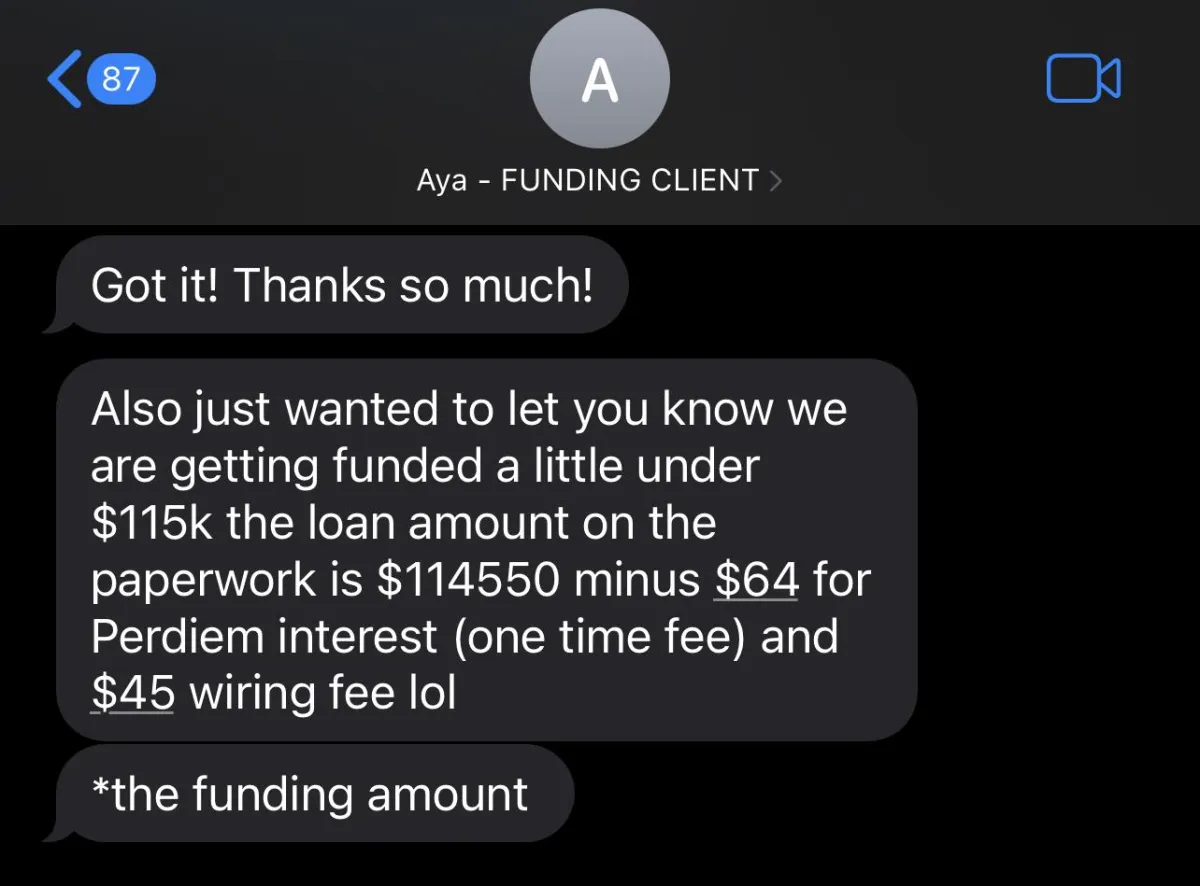

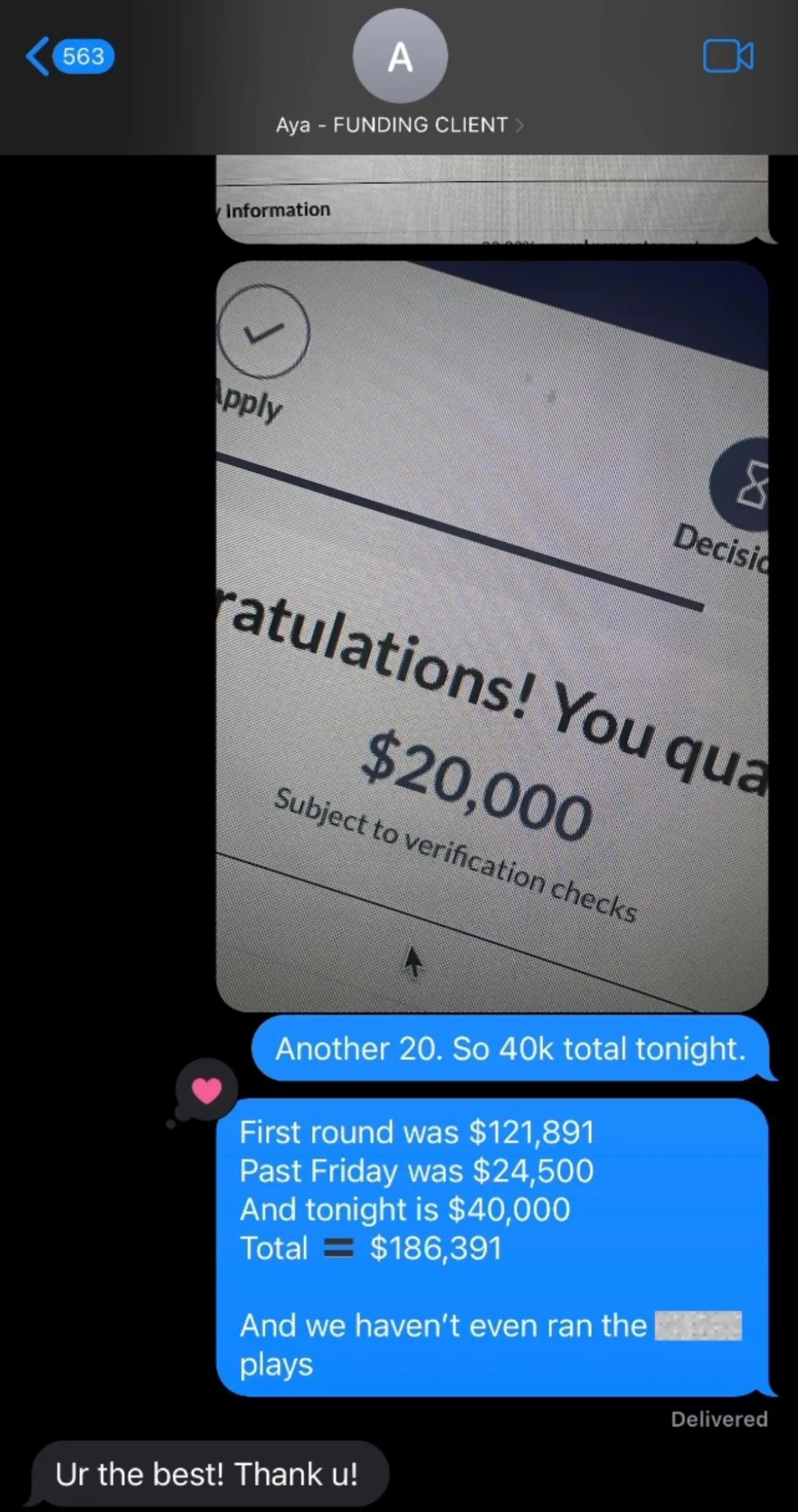

Aya Kawash

Gentlemen Auto Services

Niche: Real Estate

Result: From $0 to $209K in funding

Kawash Property Services: Aya went from $0 to $209K in Available Credit in Less Than 2 Months!

Aya reached out to us with the goal of securing funding for the expansion of her and her husband's home renovation business. We developed a plan to utilize a blend of 0% interest business credit cards and a low-interest business loan, capitalizing on their current income.

The Process

Aya and her husband had achieved significant success in their business but aimed to secure funding to acquire more properties for flipping along with necessary equipment. We conducted a comprehensive assessment of their business, delving into their articles of organization filings and personal credit reports, which required some improvement. Through our credit repair program, we successfully eliminated detrimental negative items and hard inquiries, boosting their credit scores to the 780s. This positioned them ideally as prime candidates for funding.

The Result

Our efforts resulted in securing them $95,000 in 0% APR business credit and $114,550 in a business loan, This achievement was accomplished in just 2 months.

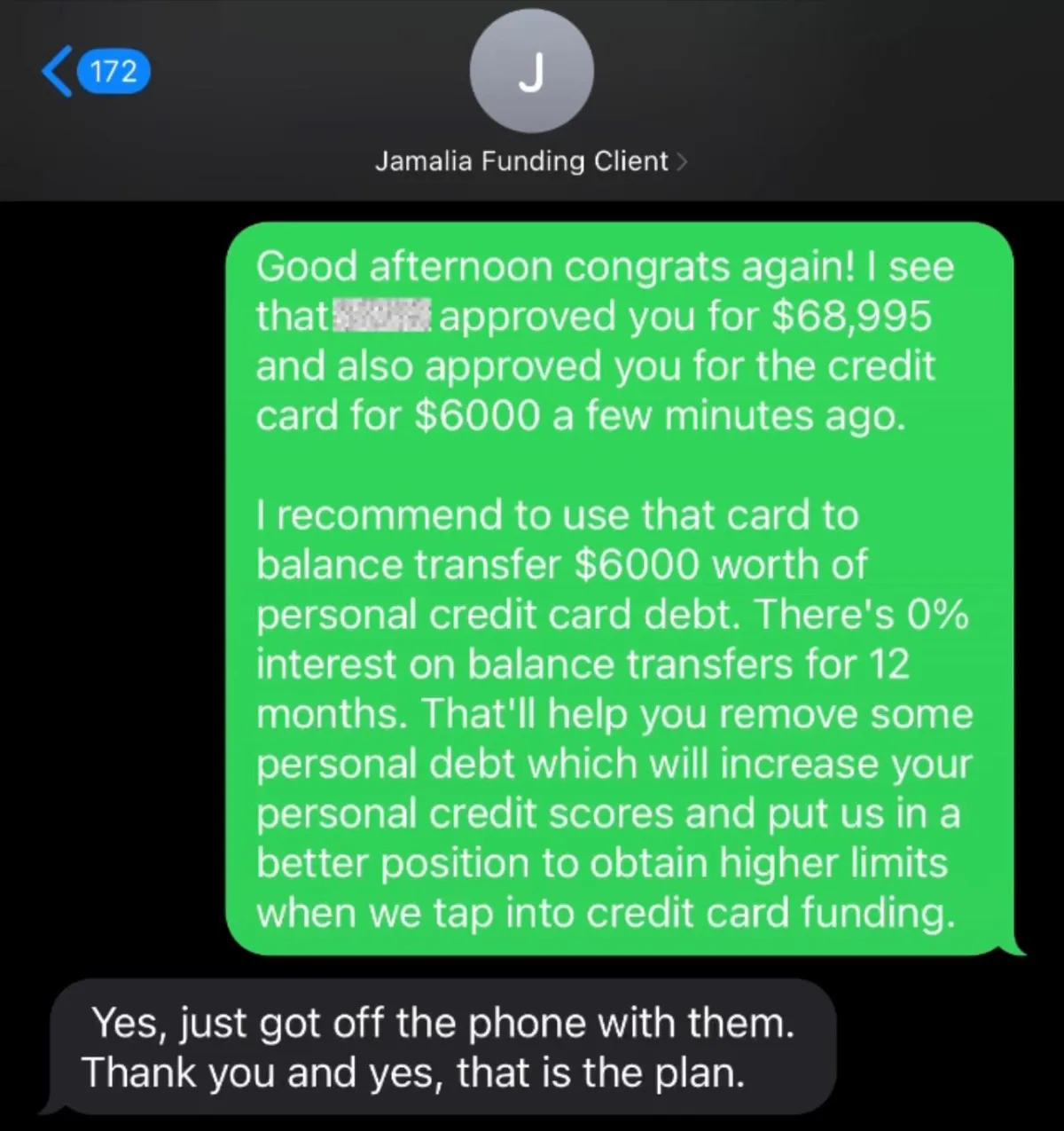

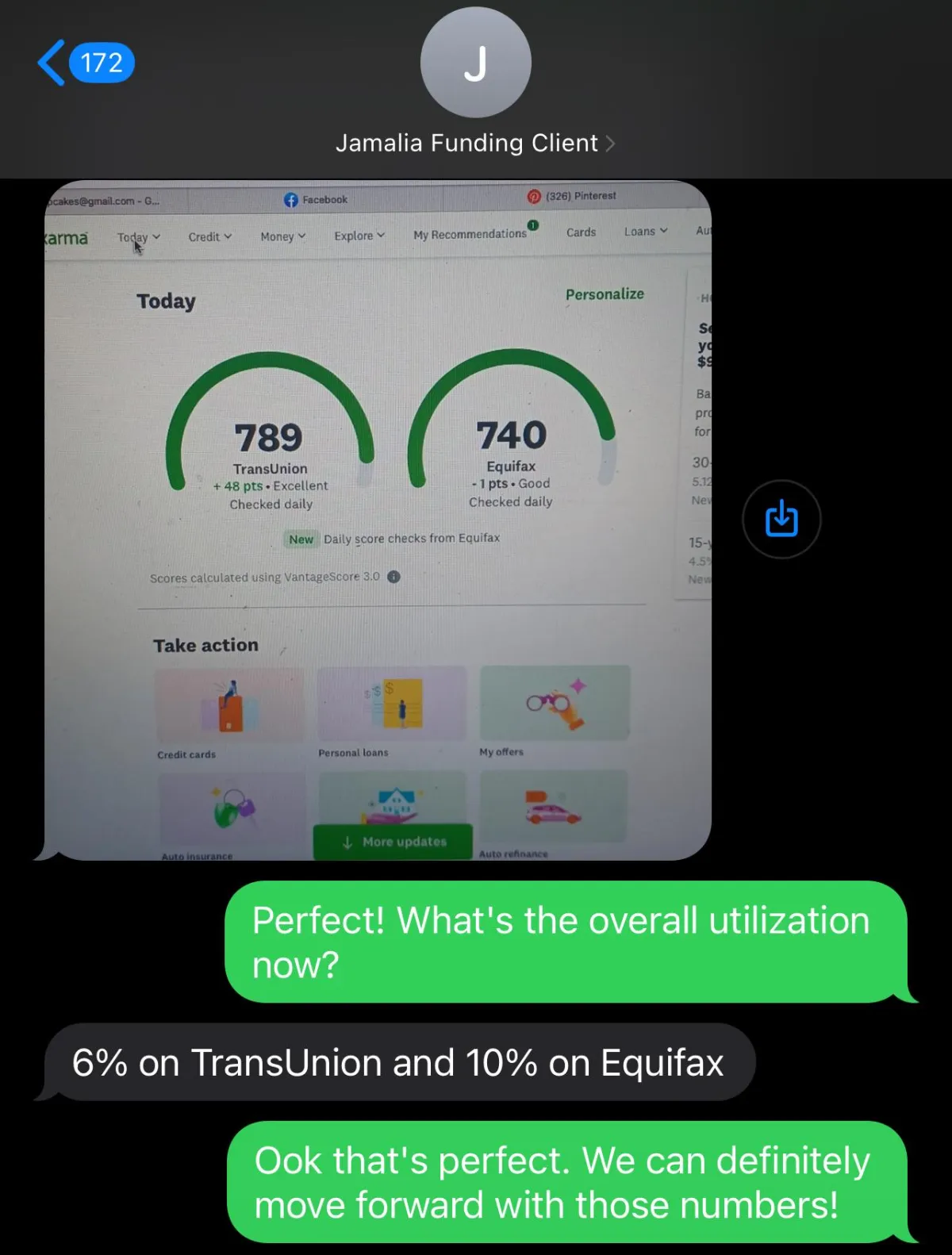

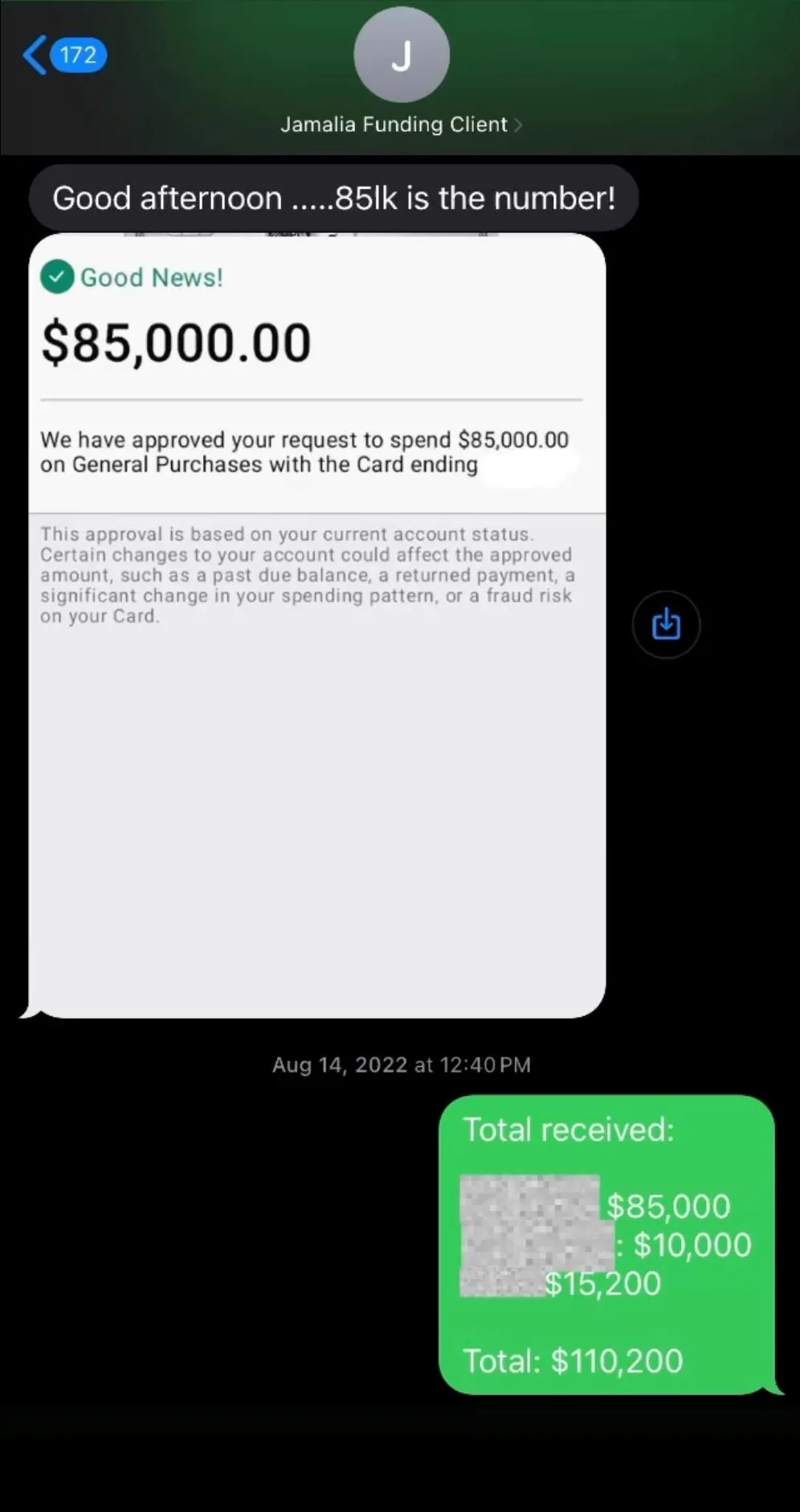

Jamelia Williams

Melia's Cupcakes

Niche: Mobile Bakery

Result: $178,995 in 62 days

Melia's Cupcakes: Jamelia was successful in securing $178,995 in business funding in Just 62 Days!

Jamelia expressed her desire to elevate her existing business to greater heights and sought the necessary funds to turn her aspirations into reality.

The Process

Jamalia approached us with a vision and an impressive credit profile. After reviewing her personal credit report structure to ensure all qualifications were met, we determined that paying down some of her existing personal credit card debt was necessary to maximize funding opportunities. We created a strategic plan to secure approval for a low-interest business loan, a portion of which would be used to reduce her personal credit card balances. As a result, her credit score surged, positioning her as an ideal candidate to obtain high-limit 0% interest business credit cards.

The Result

Within a span of only 62 days, Jamelia successfully secured a combined total of $178,995 in business funding solutions. This included 0% business credit cards spanning up to 18 months and a low-interest business loan. Jamalia utilized these resources to amplify her business by acquiring a mobile food truck. With this addition, she's now equipped to participate in various fairs and events across Atlanta, significantly broadening her business reach.

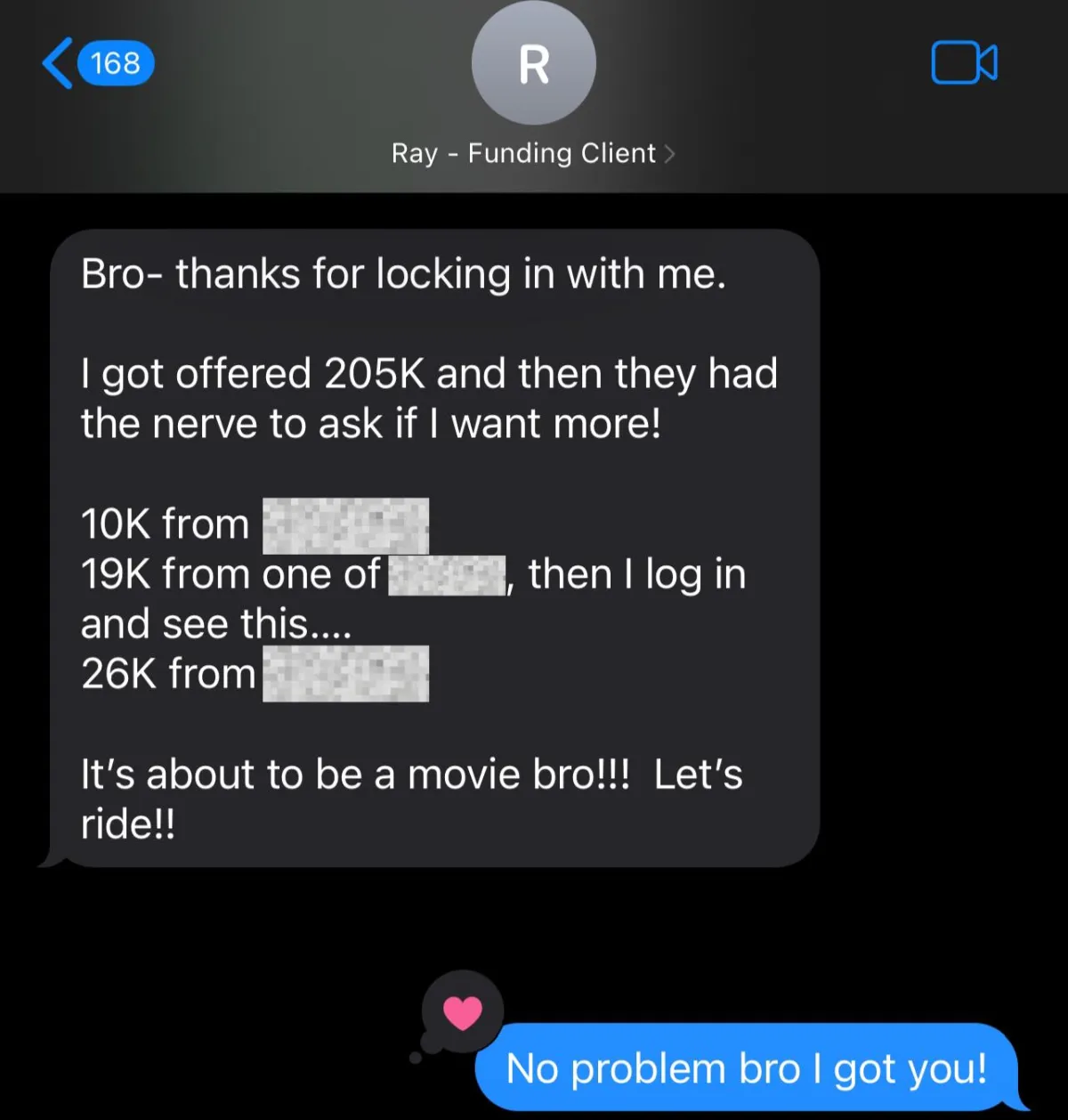

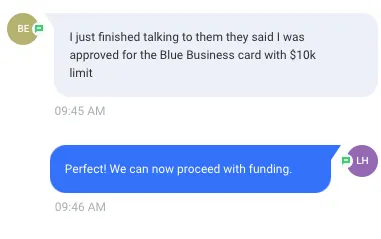

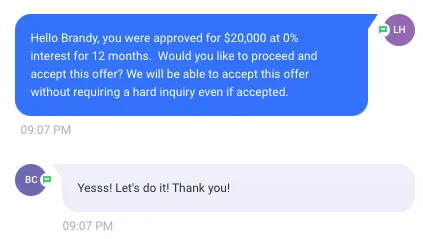

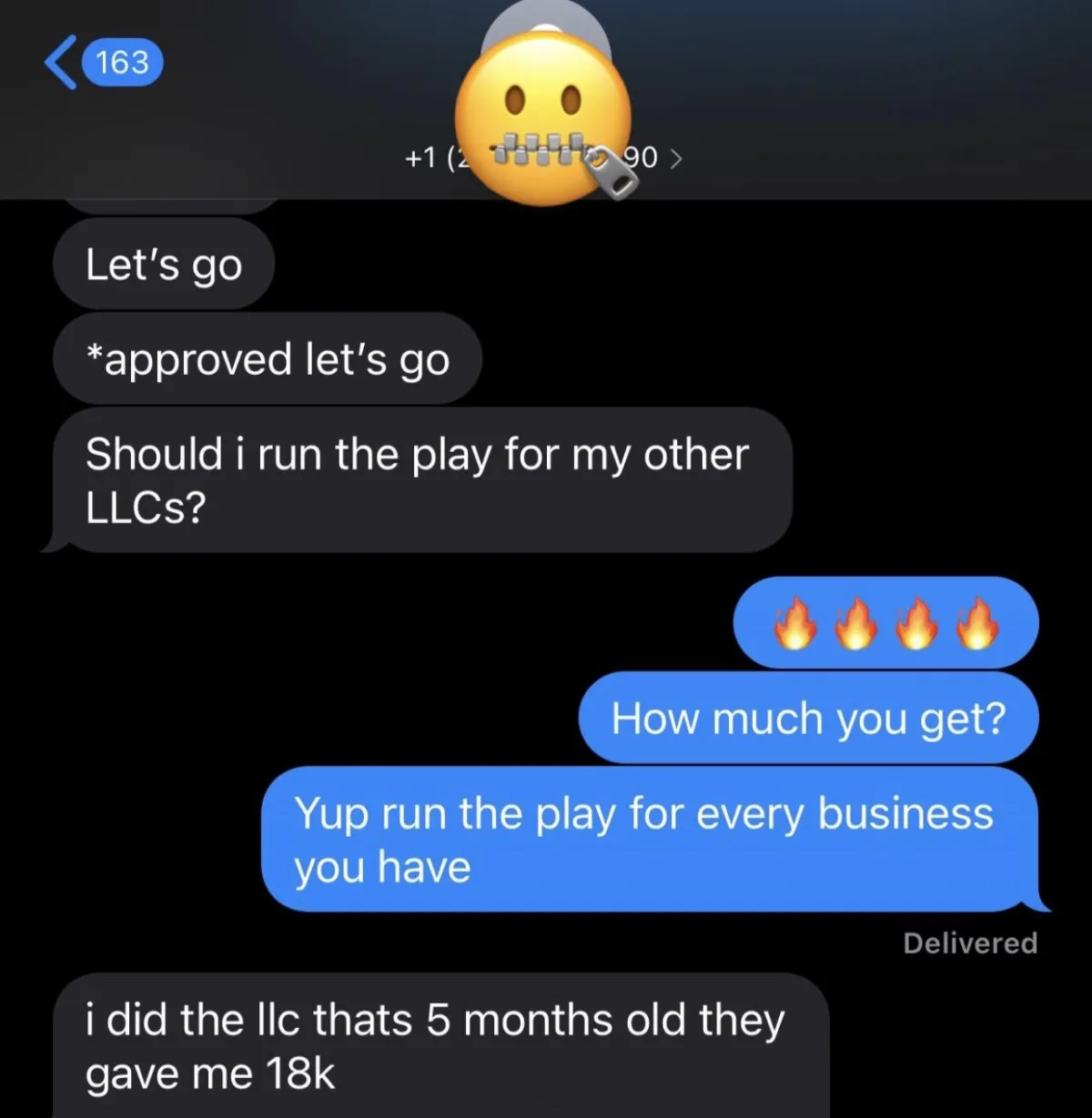

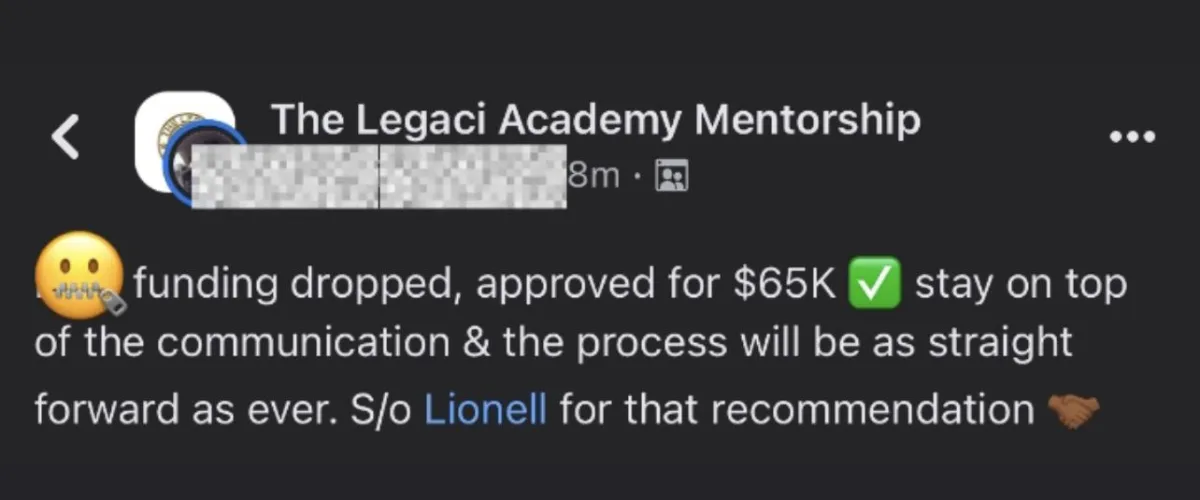

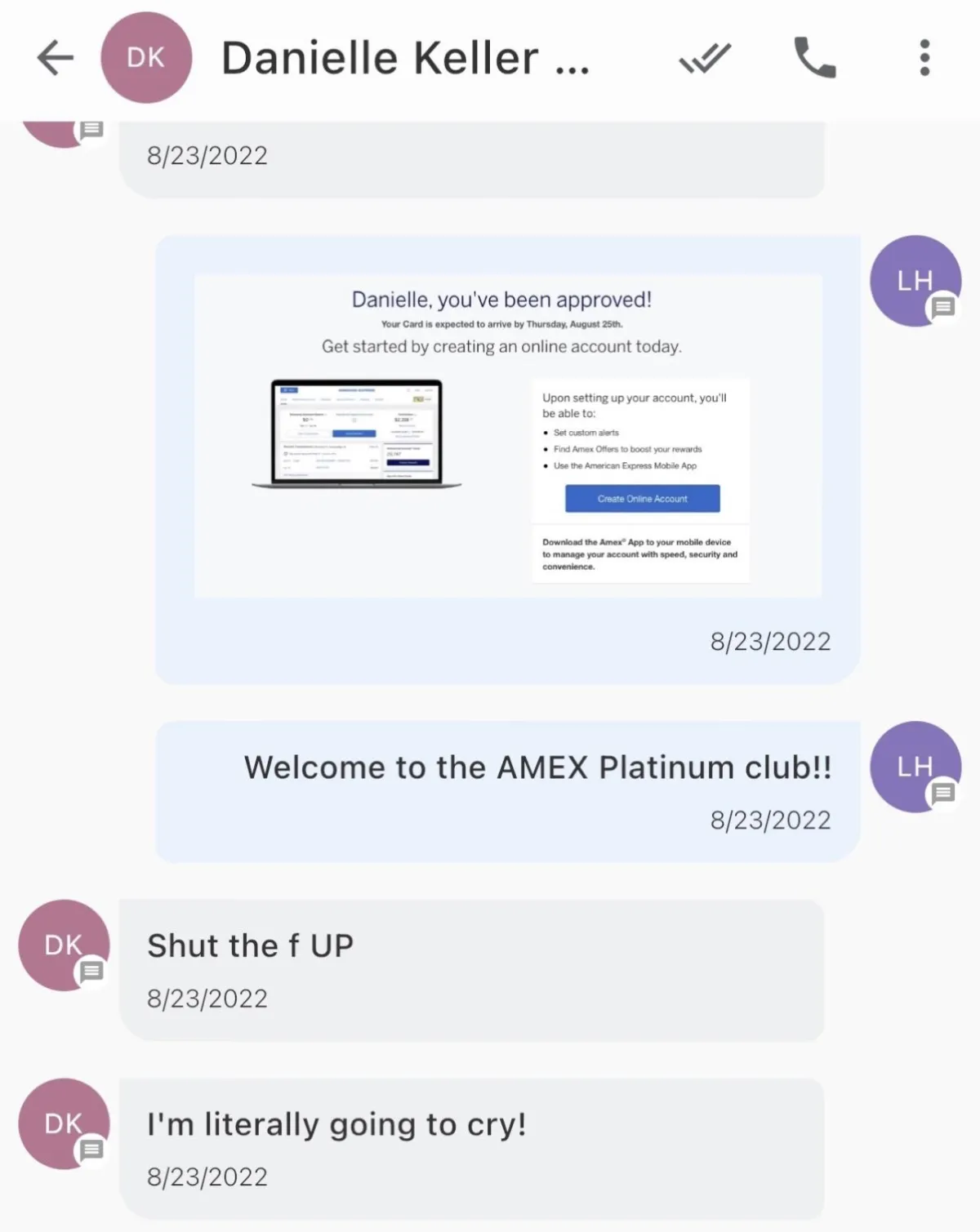

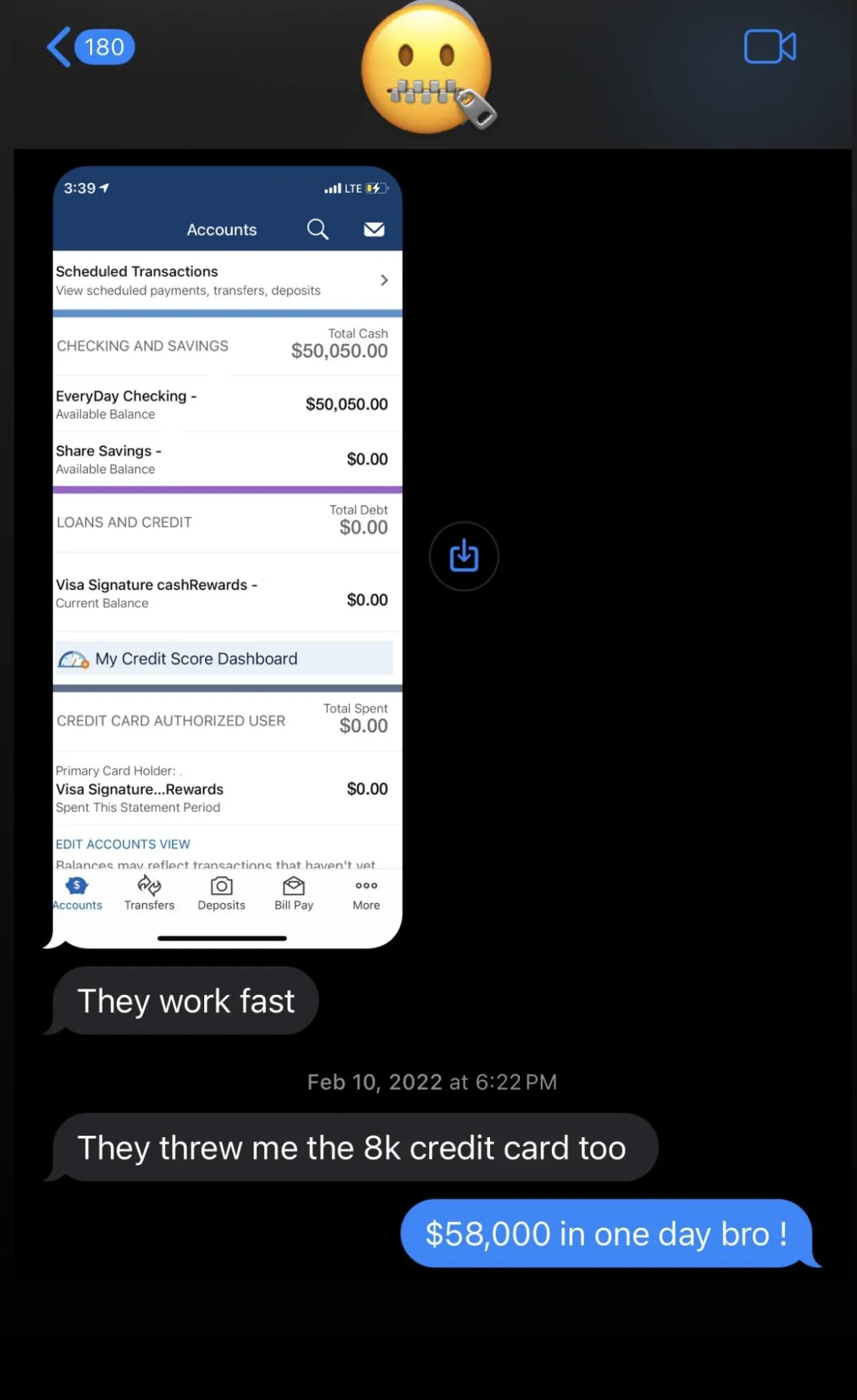

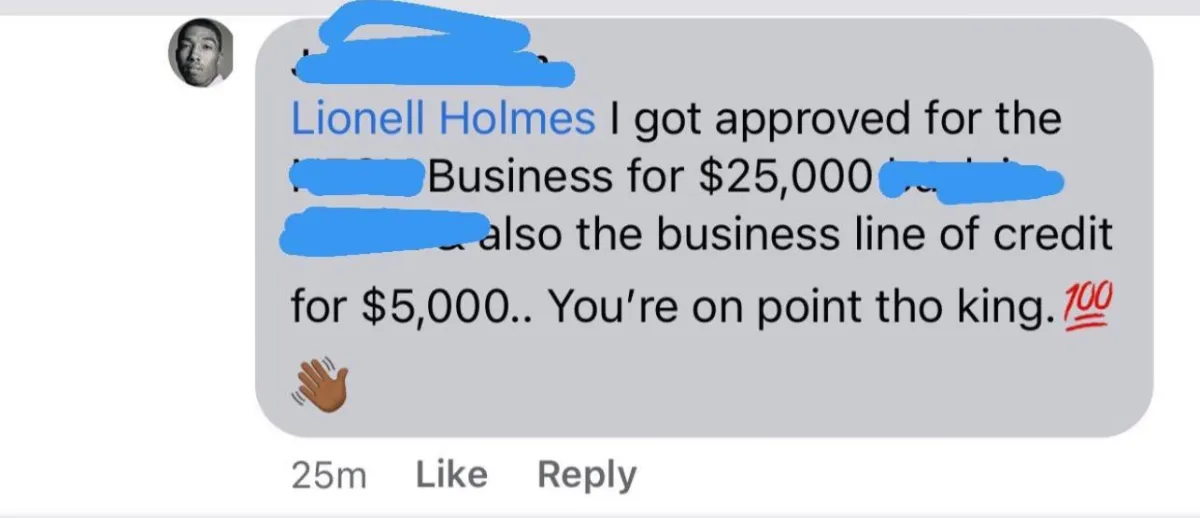

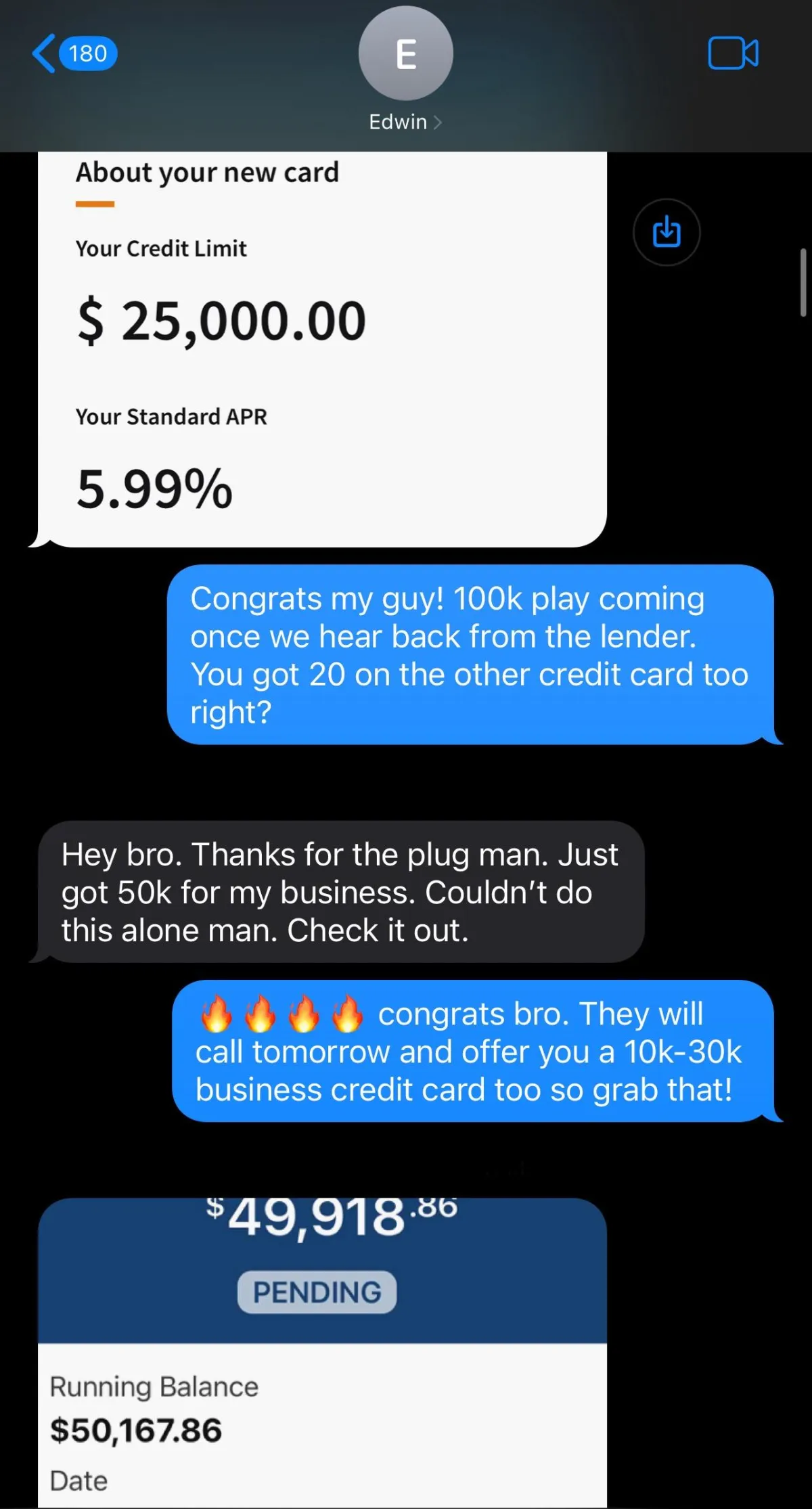

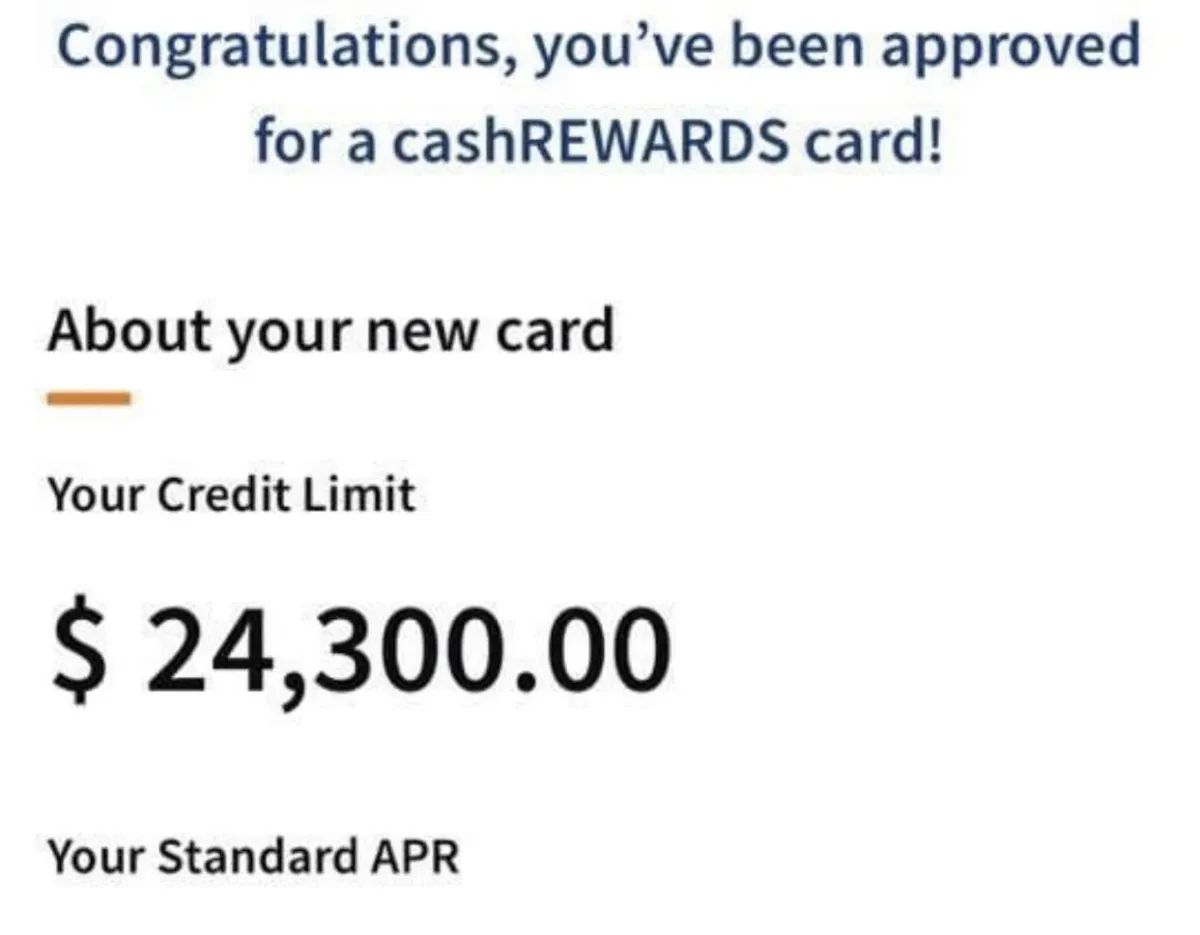

PEOPLE APPROVALS, YOU CAN BE NEXT!